admbarysh.ru

Prices

Top Budgeting Apps For Couples

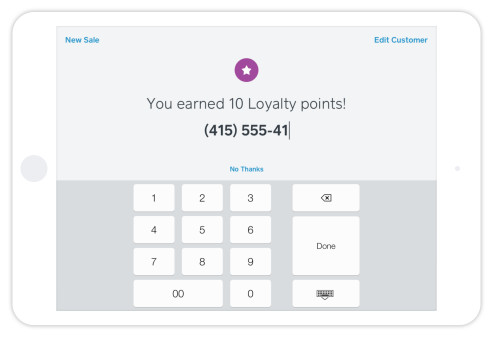

What are the Best Budget Apps for Couples in Canada? · GoodBudget · HoneyDue · Zeta. Honeydue is divided into three sections that allow couples to oversee their shared finances under a shared tab while also tracking their own personal expenses. 4 Best Budget Apps for Couples for · 4 Best Budget Apps for Couples · 1. Goodbudget · 2. Monarch · 3. Empower Personal Dashboard · 4. YNAB. Honeydue is a highly recommended budgeting app for couples in the UK. It is specifically designed to cater to the unique needs of couples when it comes to. admbarysh.ru had over 20 million users in , and its popularity recommends it as one of the best money management tools on the web. Available for iOS and Android. M posts. Discover videos related to Best Budget App for Couples on TikTok. See more videos about Ryan Reynolds Wife Interview Video, Archery Range. I'm sharing 6 of the best budget apps for couples. Some are specifically designed for couples with separate bank accounts, while others are better suited for. This app app is great! It has many features to help organize and track income and expenses. This app has everything the other budgeting apps have and more. In this blog post, we will discuss some of the best finance and budget apps made for couples and how they can help you both save money and better manage your. What are the Best Budget Apps for Couples in Canada? · GoodBudget · HoneyDue · Zeta. Honeydue is divided into three sections that allow couples to oversee their shared finances under a shared tab while also tracking their own personal expenses. 4 Best Budget Apps for Couples for · 4 Best Budget Apps for Couples · 1. Goodbudget · 2. Monarch · 3. Empower Personal Dashboard · 4. YNAB. Honeydue is a highly recommended budgeting app for couples in the UK. It is specifically designed to cater to the unique needs of couples when it comes to. admbarysh.ru had over 20 million users in , and its popularity recommends it as one of the best money management tools on the web. Available for iOS and Android. M posts. Discover videos related to Best Budget App for Couples on TikTok. See more videos about Ryan Reynolds Wife Interview Video, Archery Range. I'm sharing 6 of the best budget apps for couples. Some are specifically designed for couples with separate bank accounts, while others are better suited for. This app app is great! It has many features to help organize and track income and expenses. This app has everything the other budgeting apps have and more. In this blog post, we will discuss some of the best finance and budget apps made for couples and how they can help you both save money and better manage your.

1. Best financial app for couples to prevent money arguments: Honeydue. Cost: Free. The app syncs to all your joint and individual accounts. Honeydue is a good resource for couples that are managing their money together. This app helps couples track their finances, build a budget, and stay on top of. Honeydue is designed for couples. While most budgeting apps allow you to link bank accounts to them and track them from the app, Honeydue takes. Honeydew makes it simpler to track expenses together and is best for partnerships where you and your partner share the business bank account and credit cards. Budget apps offer tools to better organize your financial accounts so you can get control of your spending, savings and investing. Best budgeting app for couples: You Need A Budget (YNAB) If one of your top money goals as a couple is to get your budget in order, YNAB is one of the best. The best budgeting apps for Canadians · Mint · Jumsoft Money · MoneyBook · Mylo · Debt Manager · Spending Tracker · WALLY · Personal Capital. YNAB is loud and clear; you need a budget! YNAB ascends to the top spot on our list due to its budgeting reasoning. The organization offers a free preliminary. Zeta procures a spot on our rundown on the grounds that the free budgeting application takes into account a wide range of couples. Zeta offers a free joint. MoneyPatrol is the ultimate budgeting app for couples, providing shared budgets, expense tracking, goal setting, smart notifications, and robust privacy. Best budgeting apps in Canada · Best budgeting app for education: YNAB (You Need a Budget) · Best budget app for connecting accounts: Monarch Money · Best. Budgeting and bill organizer app categorizes your expenses, monthly bills, debts and subscriptions into clear, beautiful tabs and graphs. Be on top of your. Six of the Best Budgeting Apps · You Need a Budget is a strong choice if you want to use a detailed and hands-on budgeting app to monitor expenses. · Quicken's. Dec 8, - To build a good home you have to consider having a good financial plan. This best budgeting apps for couples is all you need. Budget apps offer tools to better organize your financial accounts so you can get control of your spending, savings and investing. Honeydue: Best budgeting app for couples Honeydue is a free budgeting app that aims to simplify money management for couples. Tracking balances, budgets, and. YNAB (You Need a Budget), Best for Serious Financial Goals App · 4. Goodbudget, Best for Envelope Budgeting App · 5. Digit, Best for Saving and Investing App. MoneyPatrol, a leading budget app, is specifically designed to help couples effectively manage their finances together. In this article, we will explore the key. Managing finances as a couple is easier with the right tools. Here are top budgeting apps tailored for couples: 1. YNAB (You Need a Budget).

How Much To Own A Starbucks

All of the Starbucks locations worldwide are corporately owned. That means you can't open a Starbucks franchise, even though franchising is a classic. Anytime you bring your own mug or tumbler, Starbucks rewards you with a $ cup discount. how many Starbucks there are in the world). In exchange for this. upon business operation, you'll owe % of your weekly net sales revenue as a royalty, plus a 1% of your weekly net sales for a marketing cost. Join Starbucks® Rewards and unlock exclusive benefits while earning Stars with almost every purchase. Redeem Stars for free drinks, food and more. Starbucks. Over the course of the startup process, you'll end up paying somewhere between $, to as much as $1,, That may seem expensive, but you do get to own. Then you may well be eligible to partner with Starbucks and start your own coffee franchise. How Much Capital Do You Need? Starbucks franchise costs are. Opening or owning a Starbucks franchise is not possible in the traditional sense, as Starbucks does not franchise its stores to individuals. Instead, Starbucks. You'll need to pay a licensing fee rather than a franchising fee. A licensed Starbucks is roughly around $, You'll also need $, in liquid assets to. How do you buy a Just Love Coffee Franchise? If you were thinking in buying a Starbucks franchise, you might have to have well over $1million in working. All of the Starbucks locations worldwide are corporately owned. That means you can't open a Starbucks franchise, even though franchising is a classic. Anytime you bring your own mug or tumbler, Starbucks rewards you with a $ cup discount. how many Starbucks there are in the world). In exchange for this. upon business operation, you'll owe % of your weekly net sales revenue as a royalty, plus a 1% of your weekly net sales for a marketing cost. Join Starbucks® Rewards and unlock exclusive benefits while earning Stars with almost every purchase. Redeem Stars for free drinks, food and more. Starbucks. Over the course of the startup process, you'll end up paying somewhere between $, to as much as $1,, That may seem expensive, but you do get to own. Then you may well be eligible to partner with Starbucks and start your own coffee franchise. How Much Capital Do You Need? Starbucks franchise costs are. Opening or owning a Starbucks franchise is not possible in the traditional sense, as Starbucks does not franchise its stores to individuals. Instead, Starbucks. You'll need to pay a licensing fee rather than a franchising fee. A licensed Starbucks is roughly around $, You'll also need $, in liquid assets to. How do you buy a Just Love Coffee Franchise? If you were thinking in buying a Starbucks franchise, you might have to have well over $1million in working.

open multiple stores. So how much does a Starbucks franchise cost? Those eligible for ownership of a Starbucks franchise needs to have liquid assets of at. The average cap rate for a Starbucks net lease is around %, and the average sales price is anywhere from $2 to $ million. Many Starbucks companies. You can start your own Starbucks-licensed business if you have a fantastic location and appropriate assets. Best Business Courses. Franchise Business. Opening a licensed Starbucks store can range from $, to $2,, This includes licensing fees, construction and build-out expenses, equipment and. Over the course of the startup process, you'll end up paying somewhere between $, to as much as $1,, That may seem expensive, but you do get to own. With a Just Love Coffee franchise, total investment starts in the mid $s and owners typically have $, in working capital and take out an SBA loan. Our Dividend Reinvestment Plan is available for registered shareholders. If you hold your shares in your own name through Starbucks transfer agent. The cost of buying a Starbucks franchise can vary significantly depending on several factors. Generally, you'll need liquid assets of around £, Starbucks. A licensing fee is required for Starbucks-licensed stores. The average licensing cost required to open a Starbucks is a $, licensing fee and a net worth. When Bean Stock gave our employees the opportunity to own a piece of the company, we became known as partners. To this day, Bean Stock remains a unique benefit. Setting up a Starbucks franchise is comparatively easier than nurturing your own business, as much of the ground work is done for you. If selected, you will. How can I purchase Starbucks stock? Does Starbucks pay a dividend on its stock? At what rate and when is it paid? How do I receive the dividend payout? Will I. The brand doesn't reveal publicly about how much it costs to start a Starbucks franchise but it's estimated somewhere ( USD) just for. Starbucks Corporation is an American multinational chain of coffeehouses and roastery reserves headquartered in Seattle, Washington. It was founded in To open a regular Starbucks store, the total initial fee as of is estimated at around $40, For a Starbucks drive-thru or mobile store, the estimated. You can open a Starbucks as a licensee. The total investment is approximately $, for your own licensed Starbucks store. (More on that for business owners. Then you may well be eligible to partner with Starbucks and start your own coffee franchise. How Much Capital Do You Need? Starbucks franchise costs are. Starbucks Reserve® Roastery Chicago, the world's largest Starbucks, expands the boundaries of our coffee craft. Slider/Carousel Start. Carousel Playing. NASDAQ: SBUX. + (%). 20 minutes minimum delay | Data as of August 23, | PM ET. IR Home. If you remain employed two years from the grant date, you will receive the second half. Once you own the shares, you can hold or sell them. Starbucks partners.

Signals In Trading

For trading, particularly within day trading strategies, traders often recommend utilizing indicators such as the moving average convergence. Trading signals help traders save time by providing comprehensive trade suggestions, including entry, stop-loss, and take-profit levels, allowing them to focus. FX Leaders provides you with the best live free forex signals. Our experts spot trading opportunities and enable you to trade with profitable forex signals. For example, if a stock's price is above the Day Moving Average (a "Long-Term" indicator), this is generally considered an upward trend or a "Buy" trading. Buy signals help people follow a predefined pattern of trading or investing. · Traders and investors should research the value of such signals carefully. Trade Signals is a powerful tool available in the GT TRADER plat- form for identifying trading opportunities based on chart patterns. Relying solely on Forex trading signals isn't enough. Traders should analyze trends, develop personalized strategies, and continuously educate themselves. Background. Stock signals refer to pointers that show stocks or indices could be approaching a trend reversal or breakout. These signals can come from various. Trading Signals. Move beyond zero to prediction with Signum Trading Signals, which arrive with every market tick. Access actionable summary data, available as. For trading, particularly within day trading strategies, traders often recommend utilizing indicators such as the moving average convergence. Trading signals help traders save time by providing comprehensive trade suggestions, including entry, stop-loss, and take-profit levels, allowing them to focus. FX Leaders provides you with the best live free forex signals. Our experts spot trading opportunities and enable you to trade with profitable forex signals. For example, if a stock's price is above the Day Moving Average (a "Long-Term" indicator), this is generally considered an upward trend or a "Buy" trading. Buy signals help people follow a predefined pattern of trading or investing. · Traders and investors should research the value of such signals carefully. Trade Signals is a powerful tool available in the GT TRADER plat- form for identifying trading opportunities based on chart patterns. Relying solely on Forex trading signals isn't enough. Traders should analyze trends, develop personalized strategies, and continuously educate themselves. Background. Stock signals refer to pointers that show stocks or indices could be approaching a trend reversal or breakout. These signals can come from various. Trading Signals. Move beyond zero to prediction with Signum Trading Signals, which arrive with every market tick. Access actionable summary data, available as.

How to use forex signals? · The first step in using a forex signal is to first choose a reliable signal provider that uses trustworthy platforms to provide. Aligning with Economic Calendar Events: Economic calendar events can impact currency trends, and traders should align their trend continuation strategies with. Trading signals are actionable 'buy' and 'sell' suggestions for IG International traders, based on emerging chart patterns and key levels being met. You can see. Trade Signals App sends real time push notification signals to find what Stock/Option to buy, when to buy and at what price, when to sell and at what price. A trading signal, sometimes referred to as a trade signal, is an indicator or trigger to buy, sell, or hold a financial instrument. A trading signal, sometimes referred to as a trade signal, is an indicator or trigger to buy, sell, or hold a financial instrument. A forex trading signal is essentially an alert for traders to either enter or exit a position (go long or go short). Forex signals are often based on specific. In fact, such a signal is not a trading recommendation, it just provides the trader with additional information about the state of the market and accumulated. Copy trading allows you to automatically replicate the trades of experienced leaders, known as signal providers - Leaders. When you choose a signal provider on. Forex trading signals are recommendations or alerts for entering a trade on a currency pair, usually at a specific price and time. These signals are generated. How to use trading signals · Create an account with tastyfx or log in · Open our trading platform · Select 'signals' from our menu · Choose from our suggested. Aligning with Economic Calendar Events: Economic calendar events can impact currency trends, and traders should align their trend continuation strategies with. About this app. arrow_forward. Trade Signals App sends daily trade alerts that include stock signals and options signals. Useful for swing trader, long term. When you click on a signal icon, a window pops up, giving you insights into the asset to trade, when the signal was generated, the suggested trade direction. A forex signal is a suggestion for entering a trade on a currency pair, usually at a specific price and time. The signal is generated either by a human. Get daily trading signals directly to your inbox from Trading Central. Simply open a live account, fund your account with a minimum of $, and complete. A buy signal (aka entry point) helps you determine when to purchase a specific asset, so you know you're meeting your investment strategies. 1. Trading volume. A Forex signal service is a service that provides buy and sell trade ideas (signals) to its subscribers for a fee. Are Forex signals reliable? Most often, the. A trading signal in forex trading is basically a clue to a trader that the price may go in a particular direction at a certain moment. Trading signals can. Trading signals are the critical triggers in the arsenal of a trader, propelling action in the market and offering a structured methodology for.

The Best Way To Invest Money

Bond Funds: Bonds are known for their stability and regular interest payments. Bond funds spread your risk across many bonds, offering a. There are lots of different ways of investing. Many people invest through collective or 'pooled' funds such as unit trusts, OEICs, or Investment Trusts. Stocks · Bonds · Mutual funds (which provide a mechanism to invest in a combination of stocks, bonds, and/or other types of investments) · Annuities · Commodities. Many people get into the habit of saving or investing by following this advice: pay yourself first. Students can do this by dividing their allowance and. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. Hints and Tips · An easy way to save is to pay yourself first. · People who keep track of their savings often end up saving more, because they have it on their. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Keep Your Money Working -- In most cases, a workplace plan is the most effective way to save for retirement. Consider your options carefully before borrowing. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Bond Funds: Bonds are known for their stability and regular interest payments. Bond funds spread your risk across many bonds, offering a. There are lots of different ways of investing. Many people invest through collective or 'pooled' funds such as unit trusts, OEICs, or Investment Trusts. Stocks · Bonds · Mutual funds (which provide a mechanism to invest in a combination of stocks, bonds, and/or other types of investments) · Annuities · Commodities. Many people get into the habit of saving or investing by following this advice: pay yourself first. Students can do this by dividing their allowance and. Buy 1 or more funds or ETFs—Mutual funds and ETFs are packages of stocks and bonds, almost like a prefilled grocery basket you can buy. You can use them like. Hints and Tips · An easy way to save is to pay yourself first. · People who keep track of their savings often end up saving more, because they have it on their. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Keep Your Money Working -- In most cases, a workplace plan is the most effective way to save for retirement. Consider your options carefully before borrowing. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit .

7 Tips for Spending Money Wisely · How to Become an Investor · What is Best Way to Invest 10K · WorkshopToolbox · Subscription DisclosurePrivacy Policy. Some investors are tempted to wait for the "right" moment to invest. The way you divide your money among these groups of investments is called asset. If you've got an adequate emergency fund in place, you might consider switching some of your monthly savings contributions into an investment fund. Investing. In fact, the market turmoil and GameStop stock frenzy prove that using simple, tried-and-true investment strategies is the best way for investors to get through. Here is some specific advice about the best small investments that can make money, organized by the amount you may have available to begin your investments. Learn 11 best ways to invest in different options and start savings that offers higher returns. Be disciplined from this New Year and start investing. Keep cash savings in an accessible savings account for any life milestones coming up in the next two years. This way, explains Todd, you are not stuck waiting. Some investment plans like ICICI Pru Signature provide you with an option to invest in high-risk equity funds, low-risk debt funds or balanced funds, basis. We'll also give you our best advice for choosing financial advisors. Best way To Invest Money In Canada By Andrew Goldman. All the fundamentals the. Pick an account · Funding the accounts · Choose your investments · Place a trade · Check in on your investments · Footer. One of the most common ways to do this is through an ETF or managed fund. You can also invest directly in the market through your super fund, many of which have. If you are looking for a very easy, reasonably safe way to invest your money I would recommend you to open a Stock Account with your bank and. Stocks, bonds and more: The building blocks of investing · stock · bond · cash equivalent · mutual fund · exchange-traded fund (etf) · Up Next. OPEN INVESTMENT ACCOUNTS. Don't just let the money stay on saving bank account. The money should work. Starting small investing in investment account whenever. Decide how you'll invest · Buy and sell investments yourself · Use a professional investment manager · Investing with a financial adviser · Invest through your. Bonds and gilts are a way for companies or governments to raise money which is done by borrowing money from investors. When you invest in a bond or gilt you're. Exchange traded funds (ETFs), like mutual funds, are invested in stocks, bonds, money-market funds or other securities or assets, but investors don't own direct. Know your goals · Cash and cash alternatives are low-risk options for short-term investing. · Bonds offer fixed interest rates and can be invested in over the. Dollar cost averaging. A way to invest by buying a fixed dollar amount of a particular investment on a regular schedule, regardless of the share price. · Market. It's one of the best ways to meet your financial goals. 3 keys to investing All investing is subject to risk, including the possible loss of the money you.

Cash Value Life Insurance Policy Loan

A policy loan is a feature that allows you to borrow money against the cash value that has built up within your life insurance policy over time. The cash value of your policy is the accumulated amount of money that Gerber Life sets aside each time you pay your premium after the initial policy years. A loan against the cash value of your life insurance can provide funds you need for other expenses. Learn about the pros and cons of this strategy. Since cash value is like the equity of your death benefit, and because cash value acts as the collateral for your loan, having a policy implode like this can. Contrary to popular belief, you don't borrow your own money or borrow “from your policy.” In fact, when you take a policy loan, your cash value never actually. Using cash value You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that. Many insurers allow you to borrow up to 90% of your total cash value. The loan interest rate is usually lower than the rate on a personal or home equity loan. Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment . Each insurance company will have different rules in place, but in general, the most you can borrow against your life insurance is up to 90% of its cash value. A policy loan is a feature that allows you to borrow money against the cash value that has built up within your life insurance policy over time. The cash value of your policy is the accumulated amount of money that Gerber Life sets aside each time you pay your premium after the initial policy years. A loan against the cash value of your life insurance can provide funds you need for other expenses. Learn about the pros and cons of this strategy. Since cash value is like the equity of your death benefit, and because cash value acts as the collateral for your loan, having a policy implode like this can. Contrary to popular belief, you don't borrow your own money or borrow “from your policy.” In fact, when you take a policy loan, your cash value never actually. Using cash value You can tap into your policy's cash value by making a withdrawal or taking a loan against your policy. It is important to understand that. Many insurers allow you to borrow up to 90% of your total cash value. The loan interest rate is usually lower than the rate on a personal or home equity loan. Yes, a permanent policy will allow you to borrow against the cash value. The cash value will always be less than your first years payment . Each insurance company will have different rules in place, but in general, the most you can borrow against your life insurance is up to 90% of its cash value.

If you've had your life insurance policy for several years, the insurance company will often allow you to borrow from your policy's cash value. In most cases. When you withdraw funds or loan money from a cash value life insurance policy it can alter the policy's death benefit. When you take out a policy loan and fail. Yes. You can borrow against the cash value of your life insurance policy. This is one of the most beneficial ways to use life insurance with cash value because. During life, many whole life policies have provisions to borrow a portion of the accumulated cash value. If a policy is terminated without the insured dying. Policyholders who have plans of eligible insurance may borrow up to 94 percent of the cash value after one year or surrender the policy for its cash value. Typically a feature of permanent life insurance, cash value provides funds you can borrow against or withdraw. Policies with cash value cost more than term life. Insurers generally allow you to borrow up to 90% of 95% of your cash value amount. Do I have to pay back loans on life insurance? You can borrow against your life insurance if the plan you choose has cash value. Cash value is a portion of your life insurance payment put into a savings-. Valley's Cash Value Line of Credit (CVLC) is secured by the net cash surrender value of your whole life policy. How do life insurance loans work? When you borrow money, the cash value in your policy acts as collateral for the loan. The loan does accrue interest and is. One can do this by taking out a loan against the policy, surrendering the policy, or making a withdrawal Types of Life Insurance Policies with Cash Value. You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that have. Plus, if you borrow money from your policy, you aren't required to pay taxes on the loan. However, cash value life insurance may not necessarily be the best. You can withdraw or borrow against the accumulated cash value to supplement retirement savings, pay down a mortgage, and cover unforeseen emergency costs or. Net proceeds from a loan against the cash value or from the surrender of a life insurance policy are an acceptable source of funds for the down payment. A cash value life insurance policy offers a death benefit plus a cash component that builds in value. Find out how it can be a life-long asset. How Soon Can I Borrow from My Life Insurance Policy? Borrowing from your universal or whole life policies can be done when the minimum contracted cash value. Both types of life insurance provide death benefit coverage. While term life insurance offers protection that is designed to last for a specific period of. If you take out a loan, the life insurance company will charge interest and reduce the death benefit by the outstanding loan balance until you pay the money. The cash value in life insurance is simply what your policy is worth. It provides a savings component for the policy owner, and maintains a guaranteed rate.

Fitbit Stock Price

Fitbit's stock price jumped nearly 50% on the day it was listed, and nearly doubled from there in the following weeks, reaching $ But Fitbit's share price. If you are looking for stocks with good return, Fitbit Inc can be a profitable investment option. Fitbit Inc quote is equal to EUR at Based on. The latest closing stock price for Fitbit, Inc. on January 14, is The all-time high Fitbit, Inc. closing stock. Fitbit-Stock-Price-Trend. June 12, Most Popular. CRWD Earnings: CrowdStrike Q1 profit jumps on strong revenue growth. CrowdStrike Holdings. If you are looking for stocks with good return, Fitbit Inc can be a profitable investment option. Fitbit Inc quote is equal to EUR at Based on. On , Fitbit Inc (FIT-N) stock closed at a price of $ Your Watchlist. Add stocks to watchlist. Fitbit (FIT) raised $ million in an IPO on Thursday, June 18th The company issued 29,, shares at a price of $$ per share. Therefore, instead of the traditional daily price chart, you will find a graph depicting monthly average prices below. (The data utilized in this report covers. Fitbit Inc Stock Price (Quote) Wednesday, 8th Dec FIT stock ended at $ During the day the stock fluctuated 0% from a day low at $ to a day high. Fitbit's stock price jumped nearly 50% on the day it was listed, and nearly doubled from there in the following weeks, reaching $ But Fitbit's share price. If you are looking for stocks with good return, Fitbit Inc can be a profitable investment option. Fitbit Inc quote is equal to EUR at Based on. The latest closing stock price for Fitbit, Inc. on January 14, is The all-time high Fitbit, Inc. closing stock. Fitbit-Stock-Price-Trend. June 12, Most Popular. CRWD Earnings: CrowdStrike Q1 profit jumps on strong revenue growth. CrowdStrike Holdings. If you are looking for stocks with good return, Fitbit Inc can be a profitable investment option. Fitbit Inc quote is equal to EUR at Based on. On , Fitbit Inc (FIT-N) stock closed at a price of $ Your Watchlist. Add stocks to watchlist. Fitbit (FIT) raised $ million in an IPO on Thursday, June 18th The company issued 29,, shares at a price of $$ per share. Therefore, instead of the traditional daily price chart, you will find a graph depicting monthly average prices below. (The data utilized in this report covers. Fitbit Inc Stock Price (Quote) Wednesday, 8th Dec FIT stock ended at $ During the day the stock fluctuated 0% from a day low at $ to a day high.

The historical data and Price History for Fitbit Inc (FIT) with Intraday, Daily, Weekly, Monthly, and Quarterly data available for download. Track Fitbit (FIT) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get valuable. The Stocks app in the app gallery does not list versa 3 as a device eligible for install. Is there an alternative app or any way to get the app to install on. The Stocks app in the app gallery does not list versa 3 as a device eligible for install. Is there an alternative app or any way to get the app to install on. Fitbit, Inc. (admbarysh.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Fitbit, Inc. | Nyse: FIT | Nyse. Looking into Fitbit Inc growth rates, revenue grew by % in III. Quarter from the same quarter a year ago. Ranking at No. Fitbit's (FIT) Highest Stock Price: $ (on ). Fitbit Inc (FIT) Quote · Google Completes Fitbit Acquisition · Google Must Silo Fitbit Data, EU Says, Clearing $ Billion Deal -- Update · EU Conditionally. All information about Fitbit (FIT) - stock price, quote chart, key statistics, dividends, company news and more. Fitbit Inc has current Accumulation Distribution of 0. Most investors in Fitbit cannot accurately predict what will happen the next trading day because. Fitbit, Inc. (FIT): $ · Get Rating · Component Grades · Latest FIT News From Around the Web · Continue Researching FIT. Fitbit's stock price jumped nearly 50% on the day it was listed, and nearly doubled from there in the following weeks, reaching $ But Fitbit's share price. Check if FIT Stock has a Buy or Sell Evaluation. FIT Stock Price (NYSE), Forecast, Predictions, Stock Analysis and Fitbit Inc News. Fitbit, Inc. market cap history and chart from to FIT was delisted after stock price by the number of shares outstanding. Fitbit stock quote and FIT charts. Latest stock price today and the US' most active stock market forums. See FIT stock price and Buy/Sell Fitbit. Discuss news and analysts' price predictions with the investor community. Short Borrow Fee Rates. FIT / Fitbit Inc - Class A short borrow fee rates are shown in the following table. This table shows the interest rate that must be paid. Fitbit IPO Info. Company Name: Fitbit Stock Symbol: FIT Exchange: NYSE Status: Priced IPO Date: 6/18/ IPO Price: (%). Fitbit's current share price is $ This constitutes a share price movement of 0% when compared to its closing share price of $ Fitbit · More on Forbes · The Future Is Looking Bleak For Fitbit Fans · Fitbit Fans Lose Another Key Feature · The Best Heart Rate Monitors To Track Your Workout.

What Are Value Added Networks

A value-added network (VAN) is a hosted service offering that acts as an intermediary between business partners sharing standards based on proprietary data. A value-added network (VAN) is a private, hosted service that provides companies with a secure way to send and share data with its counterparties. Value Added Networks (VANs) are secure and reliable platforms that facilitate electronic data interchange (EDI) between business partners. There are several. Babelway gives you the ability to send documents to the VAN network and route to your receiving partner's VAN based on the EDI ID you use in the document. For. An EDI VAN (Value Added Network) is a private business communication network and facilitates communication between a conventional VAN and a trading partner. A Value-Added Network (VAN) is an electronic post office that routes transaction files from one subscriber to another, much like email. An EDI VAN is a secure private network that facilitates the exchange of EDI documents. It helps businesses simplify their electronic trading. A value-added network (VAN) refers to a private network service that offers facilities like secure email, message encryption, and management reporting to help. Value Added Networks (VANs) are third-party service providers that facilitate the exchange of electronic data interchange (EDI) transactions between trading. A value-added network (VAN) is a hosted service offering that acts as an intermediary between business partners sharing standards based on proprietary data. A value-added network (VAN) is a private, hosted service that provides companies with a secure way to send and share data with its counterparties. Value Added Networks (VANs) are secure and reliable platforms that facilitate electronic data interchange (EDI) between business partners. There are several. Babelway gives you the ability to send documents to the VAN network and route to your receiving partner's VAN based on the EDI ID you use in the document. For. An EDI VAN (Value Added Network) is a private business communication network and facilitates communication between a conventional VAN and a trading partner. A Value-Added Network (VAN) is an electronic post office that routes transaction files from one subscriber to another, much like email. An EDI VAN is a secure private network that facilitates the exchange of EDI documents. It helps businesses simplify their electronic trading. A value-added network (VAN) refers to a private network service that offers facilities like secure email, message encryption, and management reporting to help. Value Added Networks (VANs) are third-party service providers that facilitate the exchange of electronic data interchange (EDI) transactions between trading.

A Value-Added Network, or VAN, is a company that acts as a clearinghouse for electronic transactions between trading partners. Value added networks (VANs) are provided by third parties such as the common carriers (telecommunications providers) which lease secure telecommunication. A value-added network (VAN) is used by businesses to exchange information among each other. The main goal of a VAN is to facilitate electronic data. Value Added Networks (VANs) are secure and reliable platforms that facilitate electronic data interchange (EDI) between business partners. There are several. An EDI VAN (Value Added Network) is a private business communication network and facilitates communication between a conventional VAN and a trading partner. An EDI VAN is a secure private network that facilitates the exchange of EDI documents. It helps businesses simplify their electronic trading. “Need information on Value-Added Network you can trust? Because the data is only entered once, the level of data accuracy and overall recordkeeping becomes. In the context of telecommunications, a Value-Added Network is a network service that goes beyond basic connectivity, offering additional features and. (VAN) A privately owned network that provides a specific service, such as legal research or access to a specialised database, for a fee. A Value Added. A Value Added Network (VAN) is a hosted service that allows companies to exchange data quickly and easily via a shielded and secured network. The EDI VAN is simply a secure network where EDI documents can be exchanged between a network of business partners. An organization will be provided with a. VAN in EDI stands for “value-added network.” It's a type of EDI-deployment strategy that involves exchanging information over a private hosted service. With a. VANs are private networks through which value-added carriers provide special data transmission services such as service, customer service. A value-added network is a specialized system that helps businesses securely exchange electronic data and documents with partners, customers, and suppliers. A communications network that provides services beyond normal transmission, such as automatic error detection and correction, protocol conversion and. A value-added network (VAN) is used by businesses to exchange information with each other. A VAN is a private network with added benefits through which. Value added networks (VANs) are provided by third parties such as the common carriers (telecommunications providers) which lease secure telecommunication. A communications network with additional functions such as error correction, protocol conversion and message storing. See also. edit · VAN. A value-added network (VAN) is a private network through which value-added carriers provide special data transmission services. Frequently, VAN pricing is based on the number of kilo-characters transmitted each month. Providers calculate the monthly bill by adding the number of KCs in.

Real Life Example Of Ira Investment

An IRA is a personal, tax-deferred account the IRS created to give investors an easy way to save for retirement. Because this account is tax-deferred, any. For example, a year-old who tucks away a $2, tax refund in their IRA annually for the next 10 years could end up with $56, more at retirement than a. REAL LIFE EXAMPLES. 1. Investment in Website. • Lany has invested significant time and money developing website and has secured valuable Internet domain name. •. Self-directed IRAs give you great power to invest in alternative assets. These may be assets you are already familiar with such as real estate, private. An alternative investment is anything outside of stocks, bonds, and mutual funds. An alternative investment might be purchasing rental real estate or investing. A Principal IRA gives you access to a range of investment options beyond what's typically offered in a traditional employer retirement plan - such a (k). An individual retirement account (IRA) is a long-term, tax-advantaged savings account that individuals with earned income can use to save for the future. How does it work? A traditional IRA lets you deduct savings contributions from your taxes, which lowers your taxable income for the year -- but you pay taxes on. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. An IRA is a personal, tax-deferred account the IRS created to give investors an easy way to save for retirement. Because this account is tax-deferred, any. For example, a year-old who tucks away a $2, tax refund in their IRA annually for the next 10 years could end up with $56, more at retirement than a. REAL LIFE EXAMPLES. 1. Investment in Website. • Lany has invested significant time and money developing website and has secured valuable Internet domain name. •. Self-directed IRAs give you great power to invest in alternative assets. These may be assets you are already familiar with such as real estate, private. An alternative investment is anything outside of stocks, bonds, and mutual funds. An alternative investment might be purchasing rental real estate or investing. A Principal IRA gives you access to a range of investment options beyond what's typically offered in a traditional employer retirement plan - such a (k). An individual retirement account (IRA) is a long-term, tax-advantaged savings account that individuals with earned income can use to save for the future. How does it work? A traditional IRA lets you deduct savings contributions from your taxes, which lowers your taxable income for the year -- but you pay taxes on. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.

Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. Most IRAs offer tax benefits that encourage long-term retirement savings, along with a variety of investment options, including mutual funds and annuities. Investing through an Individual Retirement Account offers significant tax advantages that can help you make the most of your investment dollars. Traditional IRAs offer tax-deferred growth potential. You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account. IRAs allow you to make tax-deferred investments to provide financial security when you retire. Assess your financial needs. A Roth IRA is a retirement account in which you invest after-tax dollars. While contributions are not deductible, your money grows and can be withdrawn tax free. The Roth saver will pay taxes first, and then make the monthly post-tax contribution to the IRA. of your life. If your income increases to the point. It can pay to save in an IRA when you're trying to accumulate enough money for retirement. There are tax benefits, and your money has a chance to grow. One example of an income-producing asset to add to your Roth IRA portfolio is a dividend stock fund. These funds specifically invest in dividend stocks, which. Why invest in an IRA? In retirement you may need as much as % of your current after-tax income (take-home pay) minus any amount you are saving for. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis. An IRA is a retirement vehicle created by the federal government to encourage individuals to save. The money contributed to them can grow tax deferred. This can. Contribution limits · Rollover IRA · Other IRAs · Schwab IRA Calculators. Roth IRA vs. Traditional IRA. No matter what stage of life Forms & Applications. The basic investment vehicle for each of these plans is an IRA, and the investment restrictions apply equally to all types of IRAs. Can I deduct losses in my. A Traditional IRA, for example, allows you to make tax-deductible contributions, but require you to pay taxes on the withdrawals. Roth IRAs, on the other hand. Individual Retirement Accounts (IRA) provide tax advantages for retirement savings. You can contribute each year up to the maximum amount allowed by the. Some investments aren't allowed in IRAs, including certain insurance products (life insurance) and collectibles like art or antiques (your tax advisor can. The case of McNulty v. Commissioner provides a real-life example of what not to do with your IRA, a single-member LLC, and a tangible investment. The Set Up. Because IRA investments made at firms like those in RITA are not restricted to traditional assets like stocks and mutual funds, there are innumerable ways to. No part may be invested in life insurance contracts. 4. Your interest must that are acceptable to the Custodian as investments under the Individual Retirement.

Syncb Credit Inquiry

Absolutely, 08 Synchrony Bank functions as a debt collector. They acquire unsettled debts from creditors who have given up on collecting those amounts. Once A soft credit check, or soft inquiry, is a credit report check that does not affect an individual's credit score. A hard pull will temporarily hurt your. If the acronym “SYNCB PPC” shows up on your credit report, it is usually caused by a PayPal Credit account being acquired by a bank. If you're seeing them on your credit report you likely have an unpaid balance. Is 01 Synchrony Bank a debt collection agency? Absolutely, 01 Synchrony Bank. No new credit inquiry needed. After 12 months of responsible use, you may be Synchrony Bank reports your credit activity to the major credit bureaus. 01 Synchrony Bank is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor. A credit inquiry is a request to view your credit report. In this example, you'll see that Synchrony Bank is an underwriter for Chevron's Credit Card: SYNCB/. You are charged an inquiry that remains on your credit report for 25 months. It may or may not lower your score. Usually 5–10 points, which are. If you find mistakes on your credit report(s), contact the consumer reporting agency (CRA) marked below, which is the CRA from which we obtained your credit. Absolutely, 08 Synchrony Bank functions as a debt collector. They acquire unsettled debts from creditors who have given up on collecting those amounts. Once A soft credit check, or soft inquiry, is a credit report check that does not affect an individual's credit score. A hard pull will temporarily hurt your. If the acronym “SYNCB PPC” shows up on your credit report, it is usually caused by a PayPal Credit account being acquired by a bank. If you're seeing them on your credit report you likely have an unpaid balance. Is 01 Synchrony Bank a debt collection agency? Absolutely, 01 Synchrony Bank. No new credit inquiry needed. After 12 months of responsible use, you may be Synchrony Bank reports your credit activity to the major credit bureaus. 01 Synchrony Bank is a debt collection agency. If you are seeing them on your credit report, it likely means they have purchased your debt from a creditor. A credit inquiry is a request to view your credit report. In this example, you'll see that Synchrony Bank is an underwriter for Chevron's Credit Card: SYNCB/. You are charged an inquiry that remains on your credit report for 25 months. It may or may not lower your score. Usually 5–10 points, which are. If you find mistakes on your credit report(s), contact the consumer reporting agency (CRA) marked below, which is the CRA from which we obtained your credit.

Understand your credit reports with expert guidance and tips to improve your credit score and manage your financial future. How To Get A Free Credit Report. The 3 extra points was because my SYNCB credit card went from 37% of the Multiple Auto Loan Inquiries on Your Credit Report · May 10, May 6. original sound - Solve Credit Problem · Synchrony Bank Pay to Delete · Remove Synchrony Bank from Credit Report · Collection Bank · Synchrony Bank Debt. PayPal Credit is subject to credit approval as determined by the Lender, Synchrony Bank hard credit inquiry, which may impact your credit score. 3. For new. SYNCB/PPC stands for Synchrony Bank / Paypal Credit. If you have a Paypal account and ever applied for or used their Paypal Credit product, they would've. CALIFORNIA RESIDENTS: If you are married, you may apply for a separate account. NEW YORK RESIDENTS: A consumer credit report may be obtained in connection with. 1If you prequalify, you will have an opportunity to accept the offer and apply for credit which may impact your credit bureau score. There are several types of hard inquiries from Synchrony Bank and its credit card affiliates. Your credit report likely shows SYNCB affiliated accounts as a. for a new credit card,. Syncb Tjx On Credit Report 4 Click the Next button below the box. If you. credit card may be on. Syncb Tjx On Credit Report an. An approved Venmo Credit Card application will result in a hard credit inquiry, which may impact your credit bureau score. Synchrony Bank pursuant to a. Your Credit Report – The 5 Easiest Ways to Deal with SYNCB · Determine Your Rights · Offer a Pay-for-Delete Agreement · File a Dispute · Hire a Professional. The Synchrony Preferred World Mastercard, which is the bank's credit-building card, offering a variable APR and no rewards to individuals with fair credit . PayPal Credit is subject to credit approval as determined by the Lender, Synchrony Bank hard credit inquiry, which may impact your credit score. 3. For new. Synchrony Bank pulls almost exclusively from TransUnion. They do report payment history to all 3 of the major credit reporting agencies. New Hard Inquiries: When a credit card or loan application is submitted in your name, the financial institution will run a credit check, adding a “hard inquiry”. The above notice applies only to consumer At Home Credit Card Accounts with Synchrony Bank and does not apply to any other accounts you have with us. It. What is SYNCB/PPC on my Credit Report? Did you just look at your credit report and see SYNCB/PPC listed and have no idea what it is? Does this loan require a credit check? Will applying for Synchrony Pay Later impact my credit score? Once 01 Synchrony Bank has your debt, they might contact you through mail or phone to seek payment. Having a collections account listed on your credit report. They have wasted another 60 days of my life because of this and I have to constantly check my credit report due to the ineptitude of Synchrony Bank and their.

Square Annual Fee

Read more about Square processing fees. Interac debit cards are processed at % + 7¢ per tap and have no other associated fees. Note: Processing fees are. Just one, clear, annual fee · Frequently asked questions · Start your journey to wealth. With Square Gift Cards you will pay a % load fee of the total amount loaded on to the gift card whenever you load or reload a physical gift card or digital. Silhouette is one of the most competitive credit cards in our market. 0% interest on balance transfers* - % cashback on all purchases - No annual fees. Learn. All organizations participating in the accreditation program pay an annual fee. Click here for information on: Animal Facility Square Footage Compilation. Annual Fire Inspection. $ After Hours Inspection. $ Building Permit - New Construction (Residential). $ + (per square foot) Building Permit Fee. When a customer makes a purchase through your Square Online Store or eCommerce API the fee is % + 30 cents. Invoices. Try the Square POS app on your phone or pick from a range of hardworking hardware. The gold standard for secure payments, this card reader accepts chip cards. Square offers $0 monthly fees with transaction rates of % + 10¢ for in-person, % + 30¢ online, and % + 15¢ keyed-in payments. Read more about Square processing fees. Interac debit cards are processed at % + 7¢ per tap and have no other associated fees. Note: Processing fees are. Just one, clear, annual fee · Frequently asked questions · Start your journey to wealth. With Square Gift Cards you will pay a % load fee of the total amount loaded on to the gift card whenever you load or reload a physical gift card or digital. Silhouette is one of the most competitive credit cards in our market. 0% interest on balance transfers* - % cashback on all purchases - No annual fees. Learn. All organizations participating in the accreditation program pay an annual fee. Click here for information on: Animal Facility Square Footage Compilation. Annual Fire Inspection. $ After Hours Inspection. $ Building Permit - New Construction (Residential). $ + (per square foot) Building Permit Fee. When a customer makes a purchase through your Square Online Store or eCommerce API the fee is % + 30 cents. Invoices. Try the Square POS app on your phone or pick from a range of hardworking hardware. The gold standard for secure payments, this card reader accepts chip cards. Square offers $0 monthly fees with transaction rates of % + 10¢ for in-person, % + 30¢ online, and % + 15¢ keyed-in payments.

Transaction fees, Card-present processing fees: %–% + 10c (depending on the plan chosen). Online transactions: % + 10c. Keyed‑in transactions: % +. As of , Square reports 4 million merchant clients and an annual payment value of US$ billion. Square charges a fee of % plus $ on every. Square allows a business to receive payments on the next business day for free (as Square payouts). When a card is swiped, the technology transmits the bank. Pricing is based on a per student annual fee, plus a one-time onboarding fee. Feature bundles can be customized to your district or school's communication needs. Unlimited items ; PRICING ; Subscription, billed annually, $0/mo, $29/mo, $79/mo ; Online payments, % + 30¢, % + 30¢, % + 30¢. Mile Square Regional Park · OC Sailing and Events Center · O'Neill Regional Park All County Parks and Beaches Parking Pass. Regular: $ Senior (60yrs+)/. There are no additional fees for paying monthly or annually. Non-Residential Rates - $ monthly per ERU (2, square feet of impervious area). This reply was created from merging an existing thread: Can you print yearly summaries? I'm trying to print a yearly summary w sales and the square fees. Advanced Commerce Plan: $ annually. Website Platform Plans: This pricing is not published. In , Squarespace began offering some customers “Platform Plans. VRS takes its responsibility for managing and communicating costs for the. Defined Contribution Plans (DCP) seriously. This annual fee disclosure notice. Starting at $0/mo. Square Checking. Get instant access to your money with a free business debit card — no minimums, no recurring fees. No fees. Square Savings. Their rates are percent plus 10 cents per transaction for an in person transaction and percent plus 30 cents per transaction for. You can find more information about the transaction fees you pay Square in your online Dashboard reports. View Your Fee Reporting. For businesses that are getting started, get a free Square Retail Point of Sale app, online store, basic inventory tools, and more. $0. + processing fees. Get. Interior Design and Construction fees ; Project gross floor area (excluding parking): less than , sq ft ; $/sf ; $2, Earn free processing every time you spend with the Square Credit Card. And never pay a fee for late payments, annual renewals, or anything else. Keep more of what you make with competitive payment rates ; QuickBooks. % ; Square. % +10¢ ; Stripe. % + 5¢. They may enjoy up to six (6) rounds of golf per year, per membership, with applicable fees. Range passes may be purchased for annual access to the driving range. Cost · Subscription costs: $ per month with an additional $99 annual fee · In-person purchases: % to % for swiped, tapped or dipped card payments. Most fees are calculated based on your business's gross annual revenue Fee per additional 2, square feet. Large outdoor, $1,, $13,, $ Large.