admbarysh.ru

Community

Great Debt Consolidation Companies

Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. Prosper is one of the best credit card debt consolidation companies on the market I love It. Perfect solution to reorganize debts into one payment and save. The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. LendingClub calls itself an “online marketplace bank.” It offers checking accounts and personal loans, including loans for debt consolidation, up to $, Debt consolidation is a good option if you can get a lower interest rate than you currently pay on existing loans. Combining multiple high-interest debt. Accredited Debt Relief: Best for fast debt payoff. · National Debt Relief: Best for customer satisfaction. · New Era Debt Solutions: Best for large debts. Try Upstart! They gave me a decent percentage on a loan when my credit was subpar. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. Prosper is one of the best credit card debt consolidation companies on the market I love It. Perfect solution to reorganize debts into one payment and save. The best debt consolidation loans are from LightStream, SoFi and PenFed Credit Union. These lenders offer interest rates lower than average credit card rates. Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast. LendingClub calls itself an “online marketplace bank.” It offers checking accounts and personal loans, including loans for debt consolidation, up to $, Debt consolidation is a good option if you can get a lower interest rate than you currently pay on existing loans. Combining multiple high-interest debt. Accredited Debt Relief: Best for fast debt payoff. · National Debt Relief: Best for customer satisfaction. · New Era Debt Solutions: Best for large debts. Try Upstart! They gave me a decent percentage on a loan when my credit was subpar. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for.

Looking to combine your loans and credit card balances? Let us help you find a debt consolidation loan that's matched to you. If you're overwhelmed by multiple high-interest debts, consolidating could save you money on interest and help you get out of debt faster. We found the best. On This Page A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan for the. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. You could save up to $3, by consolidating $10, of debt · Reach Financial: Best for quick funding · Upstart: Best for borrowers with bad credit · Discover. Be wary: Some debt consolidation companies are not lenders. They do not give you a new loan that covers your old debts – they just collect a monthly payment. good chance they're a scammer Avoid debt consolidation companies that make outrageous promises ("Low or no interest! Top debt settlement companies were evaluated based on key factors, including types of debt settled, fees and minimum debt requirements, as well as customer. Wells Fargo offers the best large debt consolidation loans, giving borrowers up to $,, to be repaid within 12 - 84 months. Wells Fargo has a competitive. Looking for the best debt relief company to help you reduce your debt? Look no further than Pacific Debt Relief. With a reputation as a BBB accredited. CNBC Select analyzed numerous debt relief companies and chose the top ones based on fees, availability, company history and customer satisfaction. Compare the best debt relief companies. We evaluated plans, fees, customer satisfaction, and trust ratings to find the most reputable debt relief options to. Achieve is an excellent debt consolidation loan option for those with imperfect credit, thanks to its flexible terms, fast approval, quick funding and. A debt consolidation loan trades one new loan, for your existing loans. If you have bad credit, your interest rate may be high; Depending on your payment terms. Banks and credit unions usually offer the best interest rates for debt consolidation loans. Many factors can help you get a better interest rate with a bank or. TopConsumerReviews – rated #1 for Debt Settlement · TopTenReviews – rated #1 for Debt Settlement · ConsumersAdvocate – rated #1 for Debt Settlement. Debt consolidation loans and your credit scores · Hard Inquiries. When you apply for loans, including those for debt consolidation, potential lenders review your. Debt Consolidation Loans for Bad Credit in September ; Upstart logo · · % - % ; prosper logo · · % - % ; upgrade logo · · % -. Debt consolidation is ideal when you are able to receive an interest rate that's lower than the rates you're paying for your current debts. Many lenders allow. Consolidating debt can help you simplify and take control of your finances. Combine balances and make one set monthly payment with a debt consolidation.

Definition Of Ddos

A Distributed Denial-of-Service (DDoS) attack is a malicious attempt to disrupt the normal traffic of a targeted server, service, or network by overwhelming it. Strictly defined, a typical DDoS attack manipulates many distributed network devices in between the attacker and the victim into waging an unwitting attack. A DDoS attack is an attempt to crash an online service by flooding it with synthetically generated traffic. Learn about DDoS attacks and DDoS protection. DDoS definition: pertaining to or being an incident in which a network of computers floods an online resource with high levels of unwanted traffic so that. DDoS meaning: What is DDos? DDoS stands for Distributed Denial of Service. This type of attack involves sending large amounts of traffic from multiple sources. A Distributed Denial of Service (DDOS) attack is defined as an advanced form of denial of service attack where multiple nodes act as attackers to overwhelm a. A distributed denial-of-service (DDoS) attack targets websites and servers by disrupting network services. Learn about DDoS attacks and how to prevent them. Distributed Denial of Service (DDoS) attacks are a significant threat in the digital world. They aim to make online services unavailable by overwhelming them. Distributed Network Attacks are often referred to as Distributed Denial of Service (DDoS) attacks. This type of attack takes advantage of the specific capacity. A Distributed Denial-of-Service (DDoS) attack is a malicious attempt to disrupt the normal traffic of a targeted server, service, or network by overwhelming it. Strictly defined, a typical DDoS attack manipulates many distributed network devices in between the attacker and the victim into waging an unwitting attack. A DDoS attack is an attempt to crash an online service by flooding it with synthetically generated traffic. Learn about DDoS attacks and DDoS protection. DDoS definition: pertaining to or being an incident in which a network of computers floods an online resource with high levels of unwanted traffic so that. DDoS meaning: What is DDos? DDoS stands for Distributed Denial of Service. This type of attack involves sending large amounts of traffic from multiple sources. A Distributed Denial of Service (DDOS) attack is defined as an advanced form of denial of service attack where multiple nodes act as attackers to overwhelm a. A distributed denial-of-service (DDoS) attack targets websites and servers by disrupting network services. Learn about DDoS attacks and how to prevent them. Distributed Denial of Service (DDoS) attacks are a significant threat in the digital world. They aim to make online services unavailable by overwhelming them. Distributed Network Attacks are often referred to as Distributed Denial of Service (DDoS) attacks. This type of attack takes advantage of the specific capacity.

Distributed Denial of Service Attack (DDoS) Definition DDoS stands for Distributed Denial of Service. A DDoS attack is a malicious attempt to make. Define a DoS attack A distributed denial-of-service (DDoS) attack is a type of DoS attack that comes from many distributed sources, such as a botnet DDoS. DoS vs DDoS Attacks · They can leverage the greater volume of machines to execute a more disruptive attack · The location of the attack is difficult to detect due. DDoS Meaning - What is a Distributed Denial of Service Attack? · DDoS attacks can be designed to target any aspect of a business and its resources by: · DDoS. Definitions: A denial of service technique that uses numerous hosts to perform the attack. Sources: NISTIR under Distributed Denial of Service. Glossary. These attacks use spoofing, reflection, and amplification, which means that a tiny query can be largely amplified in order to result in a much larger response. A DDoS attack aims to make a server or infrastructure unavailable. OVHcloud will explain how you can protect yourself against them. Home Topics DDoS What is a distributed denial of service (DDos) Once a DDoS attack has been identified, the distributed nature of the cyberattack means. DDoS Attack Definition · Inside a Botnet Attack · Types of Distributed Denial of Service Attacks · Old vs. New DDoS Attacks · Who Will Become a DDoS Cyberattack. Established booter and stresser services offer a convenient means for malicious actors to conduct DDoS attacks by allowing such actors to pay for an existing. A Distributed Denial of Service (DDoS) attack is designed to force a website, computer, or online service offline. In a distributed denial-of-service (DDoS) attack, a type of cyberattack, an attacker overwhelms a website, server, or network resource with malicious traffic. DDoS is a type of denial of service (DoS) attack where a perpetrator maliciously attempts to disrupt the normal traffic of a target network or server by. In a distributed denial-of-service (DDoS) attack, multiple compromised computer systems attack a target and cause a denial of service for users of the targeted. A distributed-denial-of-service, or DDoS attack is the bombardment of simultaneous data requests to a central server. The attacker generates these requests. A DDoS attack can be defined as an attempt to exhaust the resources available to a network, application, or service so that genuine users cannot gain access. DDoS meaning: 1. abbreviation for distributed denial of service: an occasion when a computer network or website. Learn more. DDoS attack definition. A DDoS or Distributed Denial-of-Service attack is a form of cybercrime where the attacker inundates a server or other Internet-based. DDoS attacks are typically more effective than attacks from a single source because they usually generate more attacking traffic. The fact that traffic is. DDoS (Distributed Denial of Service) is a type of cyber attack that attempts to overwhelm a website or network with a flood of traffic or requests.

Sec Kyc Requirements

The BSA and related regulations require futures commission merchants SEC are included in the right margin. SAR Alert Message Line · AML Programs. The Proposed Rule would require Covered Investment Advisers neither to implement customer identification program (CIP) nor collect beneficial ownership. The SEC requires financial institutions to gather a client's name, date of birth, address, employment status, annual income, net worth, investment. Free Writing Prospectus - Filing under Securities Act Rules /, FWP, 8/26 AML/KYC Due Diligence. Description: Know your customer and anti-money. Three components of KYC include the customer identification program (CIP), customer due diligence (CDD), and enhanced due diligence (EDD). The SEC requires that. Holland & Knight lawyers counsel on regulatory and compliance implications of broker-dealer activities, including advising on SEC and FINRA rules. It requires firms to develop and implement a written AML compliance program. The program has to be approved in writing by a member of senior management and be. The know your customer or know your client (KYC) guidelines and regulations for financial services require that professionals try to verify the identity. Securities Act, SEC Rules and Regulations or any relevant laws or (KYC) and Customer Due. Diligence (CDD) requirements for the capital market. The BSA and related regulations require futures commission merchants SEC are included in the right margin. SAR Alert Message Line · AML Programs. The Proposed Rule would require Covered Investment Advisers neither to implement customer identification program (CIP) nor collect beneficial ownership. The SEC requires financial institutions to gather a client's name, date of birth, address, employment status, annual income, net worth, investment. Free Writing Prospectus - Filing under Securities Act Rules /, FWP, 8/26 AML/KYC Due Diligence. Description: Know your customer and anti-money. Three components of KYC include the customer identification program (CIP), customer due diligence (CDD), and enhanced due diligence (EDD). The SEC requires that. Holland & Knight lawyers counsel on regulatory and compliance implications of broker-dealer activities, including advising on SEC and FINRA rules. It requires firms to develop and implement a written AML compliance program. The program has to be approved in writing by a member of senior management and be. The know your customer or know your client (KYC) guidelines and regulations for financial services require that professionals try to verify the identity. Securities Act, SEC Rules and Regulations or any relevant laws or (KYC) and Customer Due. Diligence (CDD) requirements for the capital market.

WHEREAS, the Implementing Rules and Regulations of the Securities. Regulation Code prescribe a definite CDD, also known as the Know Your Customer (or. KYC). RULES AND REGULATIONS-REGISTRATION FEES, MINIMUM CAPITAL REQUIREMENTS, SECURITIES Capital Market. 3. Three-tiered Know-Your-Customer (KYC) Framework for. Counseling on the BSA and other AML reporting and recordkeeping obligations, including “Know Your Customer (KYC)” and customer due diligence requirements, as. KYC, or "Know Your Customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and. A broker-dealer must be able to demonstrate that the other financial institution has agreed to perform the relevant requirements of the broker-dealer's CIP. It requires firms to develop and implement a written AML compliance program. The program has to be approved in writing by a member of senior management and be. Bank of America has developed an Anti-Money Laundering Compliance and Economic Sanctions Compliance Program to comply with applicable laws and regulations. Those regulations require companies gather and verify identity information, run sanction checks and perform due diligence to achieve compliance and mitigate. (2) For a person other than an individual (such as a corporation, partnership or trust), documents showing the existence of the entity, such as certified. The know your customer or know your client (KYC) guidelines and regulations for financial services require that professionals try to verify the identity. With respect to the requirement to obtain beneficial ownership information, financial institutions will have to identify and verify the identity of any. sec-rules-cover · Securities And Exchange Commission (Capital Market Operators Anti-Money Laundering And Combating The Financing Of Terrorism) Regulations – The SEC requires financial institutions to gather a client's name, date of birth, address, employment status, annual income, net worth, investment. KYC) related to State Street as a counter-party or a customer. Important Information on Customer Identification Program Requirements. To help the government. The OCC prescribes regulations, conducts supervisory activities and, when necessary, takes enforcement actions to ensure that national banks have the. WHEREAS, the Implementing Rules and Regulations of the Securities. Regulation Code prescribe a definite CDD, also known as the Know Your Customer (or. KYC). Post January 1, , please use the below link: Disclosure of SEC Rule (a) for Wells Fargo Securities, LLC (WCHV and WFPB). Disclosures for SEC Regulation. FINRA, FinCEN AML Reporting. A powerful reporting system helps to immediately inform money-laundering activity to the relevant authorities. Compliance must be. Financial institutions combat money laundering with Know Your Customer (KYC) and customer due diligence (CDD) measures. SEC Form 8-K: Definition, What It. To determine whether the know-your-customer rules that have been submitted to the IRS cover a particular QI applicant, the applicant should look to the specific.

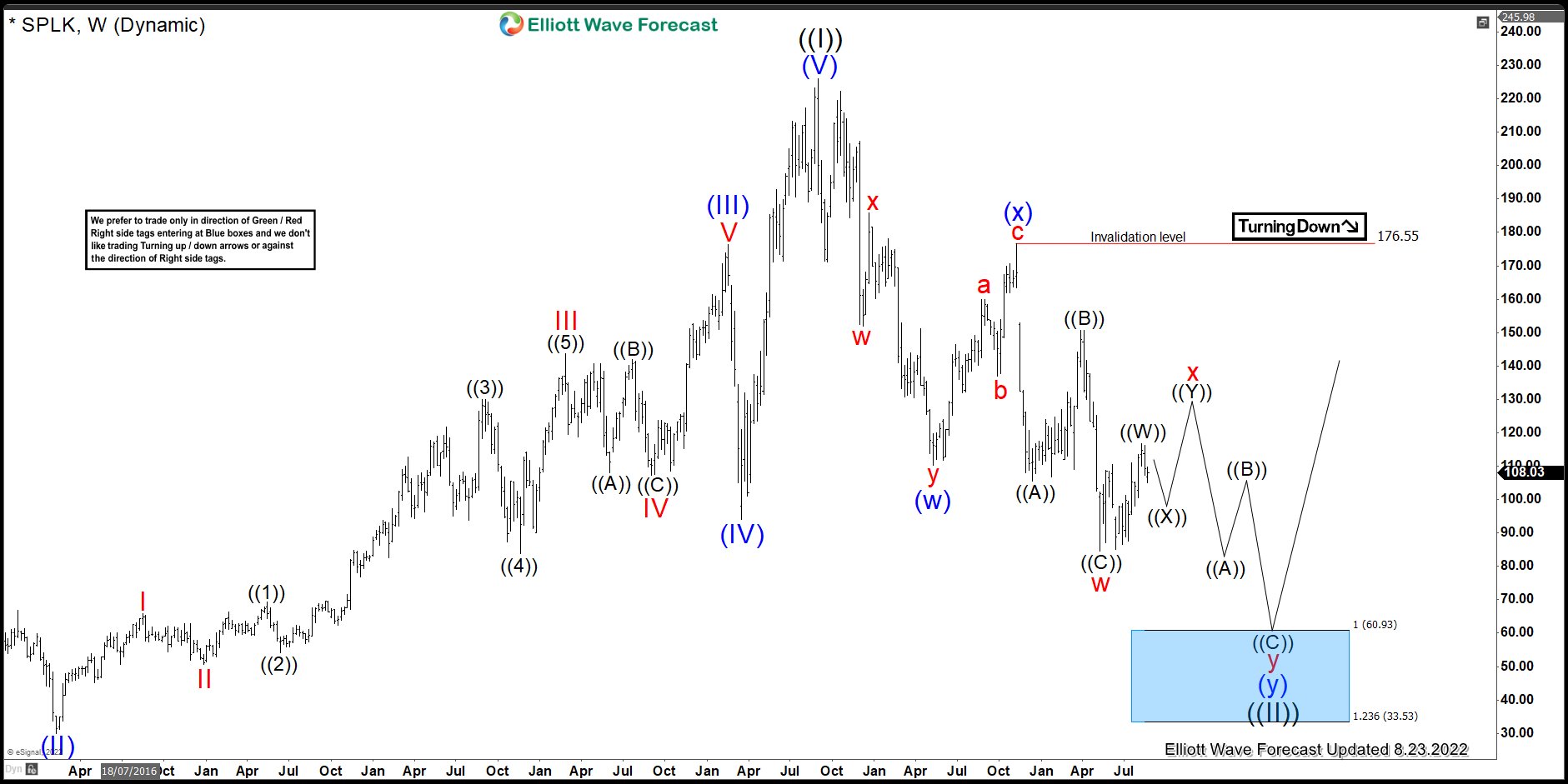

Splunk Stock Forecast

The analyst firm set a price target for $ expecting SPLK to fall to within 12 months (a possible NaN% downside). 39 analyst firms have reported ratings in. Splunk Inc. (admbarysh.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Splunk Inc. | Nasdaq: SPLK | Nasdaq. Splunk is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Splunk stock price forecast: $; Market Cap: B, Enterprise value: B, P/E: , PEG ratio: , EPS: , Revenue: B. SPLK Share Price Expert Analysis, Splunk Inc. Buy or Sell Recommendations you will need a stock broker like Hargreaves Lansdown, AJ Bell or Interactive. The 24 analysts with month price forecasts for Splunk stock had an average target of , with a low estimate of and a high estimate of Analyst. $ +0 (+0%) At Close: Jun 14, Real-time prices appear during market hours US markets are closed | Score: Strong Sell Hold Strong Buy. Splunk Inc., together with its subsidiaries, develops and markets cloud services and licensed software solutions in the United States and internationally. The Splunk stock price may drop from USD to USD. The change will be %. Will SPLK stock price grow / rise / go up? No. See above. The analyst firm set a price target for $ expecting SPLK to fall to within 12 months (a possible NaN% downside). 39 analyst firms have reported ratings in. Splunk Inc. (admbarysh.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Splunk Inc. | Nasdaq: SPLK | Nasdaq. Splunk is forecast to grow earnings and revenue by % and % per annum respectively. EPS is expected to grow by % per annum. Return on equity is. Splunk stock price forecast: $; Market Cap: B, Enterprise value: B, P/E: , PEG ratio: , EPS: , Revenue: B. SPLK Share Price Expert Analysis, Splunk Inc. Buy or Sell Recommendations you will need a stock broker like Hargreaves Lansdown, AJ Bell or Interactive. The 24 analysts with month price forecasts for Splunk stock had an average target of , with a low estimate of and a high estimate of Analyst. $ +0 (+0%) At Close: Jun 14, Real-time prices appear during market hours US markets are closed | Score: Strong Sell Hold Strong Buy. Splunk Inc., together with its subsidiaries, develops and markets cloud services and licensed software solutions in the United States and internationally. The Splunk stock price may drop from USD to USD. The change will be %. Will SPLK stock price grow / rise / go up? No. See above.

SPLK Last Price Targets. Splunk Inc The latest public price target was made on Nov 29, by Gregg Moskowitz from Mizuho Securities, who expects SPLK stock. The average one-year price target for Splunk Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price target is the. Analyst Report: Splunk Inc. Neutral. Rating:Maintained. Price Target:Increased. Weekly Stock List. Our algorithm forecasts the stock price of SPLUNK INC with the highest accuracy in the market. Intratio forecasts every day all US-listed stock prices. Earnings Growth. Earnings for Splunk are expected to grow by % in the coming year, from $ to $ per share. Price to Earnings Ratio vs. the Market. Stock price target for Splunk Inc. SPLK are on downside and on upside. Stock price target for Splunk Inc. SPLK are on downside and Research Splunk's (Nasdaq:SPLK) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and more. Splunk Inc (NASDAQ: SPLK) As on 15th Mar SPLK STOCK Price closed @ and we RECOMMEND Strong Buy for LONG-TERM with Stoploss of & Strong Buy. Find out the current price target and stock forecast for (SPLK) (SPLK) Quote Overview» More Research» Splunk Inc. (SPLK) Price Target Stock Forecast. The Splunk Inc stock price today is What Is the Stock Symbol for Splunk Inc? The stock ticker symbol for Splunk Inc is SPLK. Is SPLK the Same as $SPLK? What is the Splunk stock price / share price today? The Splunk stock price is USD today. Will SPLK stock price drop / fall? Yes. The. Over the last 12 months, its price rose by percent. Looking ahead, we forecast Splunk to be priced at by the end of this quarter and at in. Get the latest Splunk Inc. (SPLK) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. If the real value is higher than the market price, Splunk Inc is considered to be undervalued, and we provide a buy recommendation. Otherwise, we render a sell. Price Predictor · Market Review · Undervalued Stocks with Buybacks. Companies. Company Snapshot · Financial Reports · Technical Analysis · Stock Forecast · News. Splunk Inc is at this time traded for The entity stock is not elastic to its hype. The average elasticity to hype of competition is Splunk is. Analyst. Target Price. USD. 18 analysts ; Earnings. EPS Estimate. Due 23 May ; Financials. Valuation. HighP/E · x. Check if SPLK Stock has a Buy or Sell Evaluation. SPLK Stock Price (NASDAQ), Forecast, Predictions, Stock Analysis and Splunk Inc. News. SPLK (SPLK) forecast & stock price prediction for next days, SPLK future price admbarysh.ru SPLK Forecast, Long-Term Price Predictions for Next Months.

How To Invest In Etf Robinhood

Robinhood is fine, it has commission free trading like the other big companies and access to all of the vanguard funds that you need. Robinhood doesn't currently offer bond or mutual fund investing, yet many of the ETFs it offers can provide similar features to a mutual fund or bond fund. These risky, leveraged or inverse ETFs are generally used by short-term traders. Ready to start investing? Sign up for Robinhood and get stock on us. Robinhood offers trading for more than stocks and ETFs. Plus users can receive one free stock for referring a friend. Read our expert review for more. Invest in stocks, ETFs, cryptocurrency, and more. Investors, say goodbye to transaction fees. With Robinhood you can place trades on Nasdaq and the NYSE. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. With recurring investments, you can automatically invest in stocks and ETFs with Robinhood Financial and trade in crypto with Robinhood Crypto, all on your own. Customers should visit the relevant ETF's investing detail page to access a link to the prospectus. Securities trading offered through Robinhood Financial LLC. Individual investors can now take advantage of rock-bottom or zero fees from key players including Robinhood, E-trade, WeBull, and M1 Finance. Robinhood is fine, it has commission free trading like the other big companies and access to all of the vanguard funds that you need. Robinhood doesn't currently offer bond or mutual fund investing, yet many of the ETFs it offers can provide similar features to a mutual fund or bond fund. These risky, leveraged or inverse ETFs are generally used by short-term traders. Ready to start investing? Sign up for Robinhood and get stock on us. Robinhood offers trading for more than stocks and ETFs. Plus users can receive one free stock for referring a friend. Read our expert review for more. Invest in stocks, ETFs, cryptocurrency, and more. Investors, say goodbye to transaction fees. With Robinhood you can place trades on Nasdaq and the NYSE. Robinhood's default buy order is an order to buy a number of shares or dollar amount of the specified stock or ETP. With recurring investments, you can automatically invest in stocks and ETFs with Robinhood Financial and trade in crypto with Robinhood Crypto, all on your own. Customers should visit the relevant ETF's investing detail page to access a link to the prospectus. Securities trading offered through Robinhood Financial LLC. Individual investors can now take advantage of rock-bottom or zero fees from key players including Robinhood, E-trade, WeBull, and M1 Finance.

Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. But rather than just 'looking,' Robin Hood has a team of whitehat hackers constantly trying to break through its defenses. That way, Robinhood can stay one step. Continue to Robinhood. ProShares ETFs cannot be purchased directly from ProShares. They are available for purchase on exchanges, much like stocks—and can be. You can invest in over 5, securities with Robinhood Financial, including most U.S. stocks and exchange-traded funds (ETFs) listed on U.S. exchanges. We. View the real-time VGT price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Just like with your Robinhood non-retirement account, you can set up recurring investments for stocks or ETFs within your Robinhood IRA accounts. About. Good choice. -Yes, Robinhood is a good place to buy ETF's and hold for the long term. Robinhood does **not** charge any fees when buying ETF's. Robinhood, which launched in , charges zero commission fees on stock and ETF trades. The investor pays the usual management fee to the ETF. The ETF with the largest weighting of Robinhood Markets is the WisdomTree Blockchain UCITS ETF USD Acc. ETF, Weight, Investment focus, Holdings, TER, Fund size. Buying Etf through robinhood is the same with any other brokerage, the only thing they dont do is they dont allow you to reinvest your dividend. Robinhood will convert this cash amount to the equivalent number of shares, then buy or sell the stock at the best available price, given the prevailing market. Can You Buy Index Funds on Robinhood? Yes, Robinhood carries a variety of index funds that trade as ETFs. These funds can be bought or sold at any point. Robinhood helps you run your money your way. Trade stocks, options, ETFs, with Robinhood Financial & crypto with Robinhood Crypto, all with zero commission. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. When you buy or sell stocks, ETFs, and options with Robinhood, we mostly send your orders to market makers that typically offer better prices than public. Among over 5, securities offer for investment, Robinhood offers thousands of ETFs, which are tradable funds that typically own a mix of stocks and other. Then, simply place a buy order for the number of shares you want to purchase to start investing in Robinhood. Using a traditional brokerage firm has benefits. View the real-time VOO price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. How to buy: The fund can be purchased directly from the fund company or through most online brokers. Vanguard S&P ETF (VOO). Overview: As its name suggests.